Businesses struggling to access the Government’s Coronavirus Business Interruption Loans are being offered a free-of-charge lifeline by Cumbria Chamber of Commerce.

Advisers from the Growth Hub will work with Cumbrian businesses to support them in completing loan applications to maximise the chances of success and should ensure that companies get the money as quickly as possible.

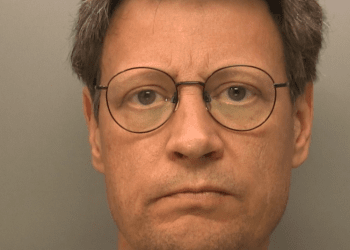

Chamber chief executive Rob Johnston said: “There’s an old adage that ‘cash is king’ and we know from our Coronavirus survey that some businesses are about to run out of it.

“The end of this month will be crunch time for many as bills fall due. Businesses could fall like dominos if they can’t get hold of funding to tide them over. This is especially true of those that aren’t trading and have no revenue coming in.

“That’s why we’re offering Growth Hub advisers to help businesses with loan applications. We don’t want to see any business go to the wall if it’s avoidable.

“They can also help businesses to review their current position and work out the best way forward as the crisis unfolds.”

Chancellor Rishi Sunak unveiled Coronavirus Business Interruption Loans (CBILS) last month as part of the Government’s package to help businesses through the crisis. These offer advances of up to £5 million in the form of loans, overdrafts, invoice finance or asset finance.

The loans are interest-free for the first year and banks cannot ask directors for personal guarantees on loans up to £250,000. The Government underwrites 80 per cent of the debt, which limits the bank’s exposure if a borrower defaults.

Even so, businesses have struggled to get hold of the loans, prompting the Government to change the rules last week following pressure from the British Chambers of Commerce.

Rob said: “CBILS is a great scheme in theory but in practice it hasn’t been working as the Government intended. The new rules should make it easier for businesses to access these loans and we’re determined to help them do that.

“Not every business wants to take on debt but, for those that were trading profitably before Coronavirus, a CBILS loan could be just what they need to see them through this crisis,” he added.

Businesses can take advantage of the Chamber’s offer of free help by emailing [email protected]

More details of CBILS and other help for businesses are available from the Chamber’s Coronavirus toolkit at https://www.cumbriachamber.co.uk/news/27976-coronavirus-what-businesses-need-to-know

This web resource has been used by more than 5,600 businesses since its launch it in February, and nearly 400 businesses have completed the Chamber’s Coronavirus survey.